The National Pension System (NPS), also known as the National Pension Scheme, is a retirement product that will help you accumulate wealth. Under this scheme, all Indian citizens and NRIs between age 18 and 60 years can invest and claim tax deductions of up to Rs. 1.5 lakh u/s 80C every year, and an additional Rs. 50,000 u/s 80CCD(1B). To open your account online, you will need to have a mobile number, an email ID and an active bank account with Net banking facility. Here is a step by step guide to it.

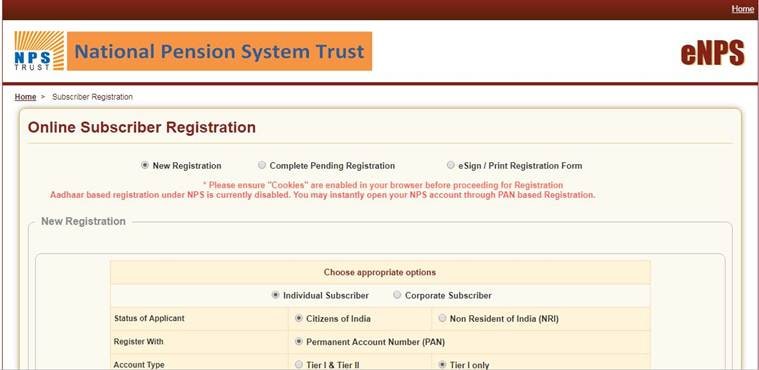

Go to eNPS website

Once you open the website, click on the tab called New Pension scheme and then go to the registration section. Select new registration, enter your Pan card number.

Subscriber registration

Enter your personal details and receive an acknowledgement number.

Bank details

Once you receive an acknowledgement receipt, the next step will ask you to enter your bank details in which you have online banking facilities. After entering the details, click on ‘Save and proceed’.

Select fund

Now you have to decide the portfolio allocation among four available funds: equity fund, in which you can put up to 50% of your money; alternative investment fund, in which you can’t put more than 5% of your money; a government securities fund; and a corporate bond fund. Once you enter the allocation details, you need to update the nominee details in the next step.

Enter Nominee details

Add your nominee details and then upload a cancelled cheque of your account, photograph and your specimen signature.

Minimum payment

Make a minimum payment of Rs 500. On successful completion of payment, your permanent retirement account number (PRAN) will be generated along with the payment receipt.

Print form

After you make a payment, click next and print the form, paste photograph & affix signature and submit the Form to Central record keeping agency (CRA).

Source: indianexpress